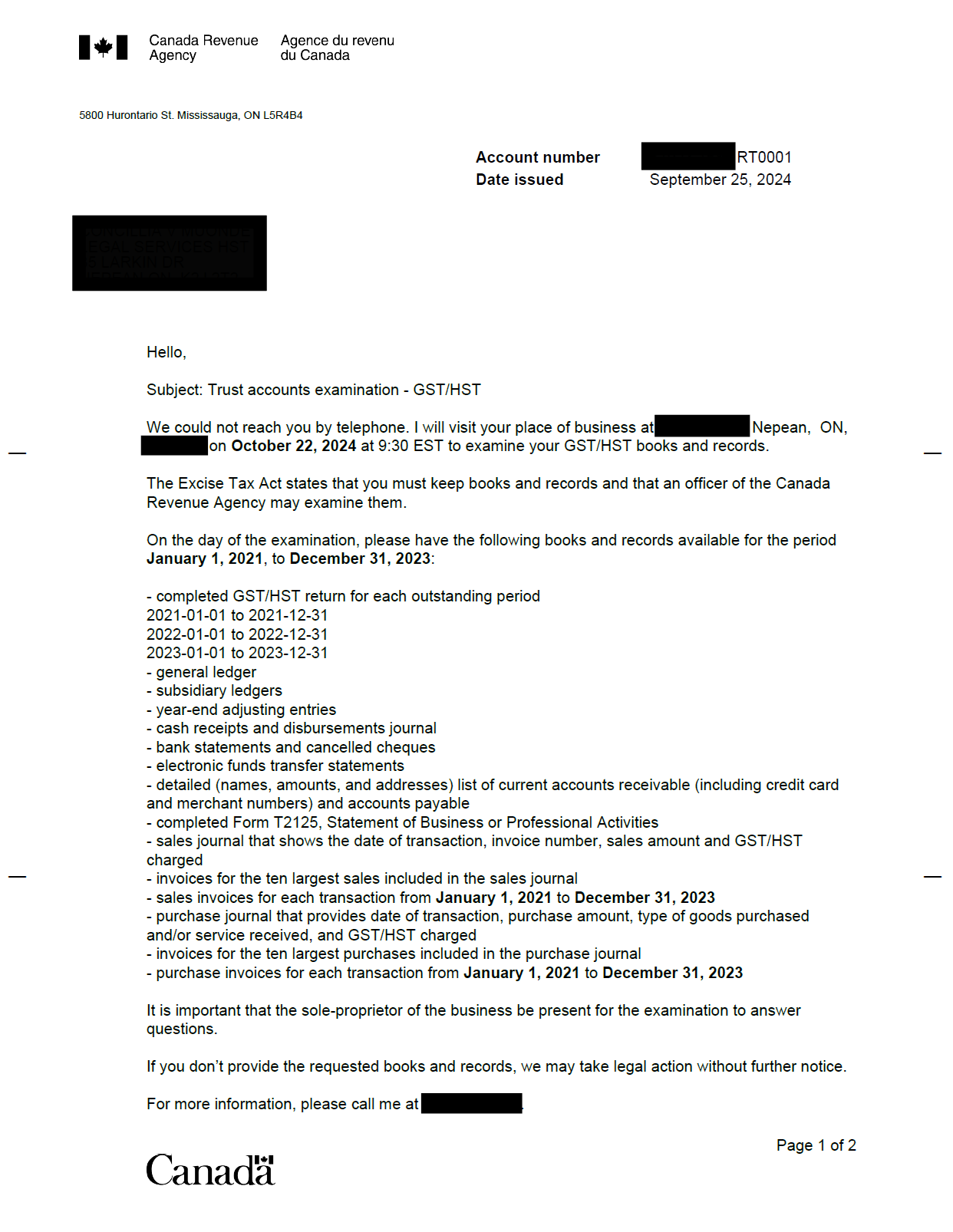

If you’ve been late on your GST/HST or payroll remittances (especially more than once in a row) it might just be a matter of time before CRA calls. CRA has made it pretty clear: if you hit certain red flags, you’re more likely to get selected for what they call a trust accounts examination.

A trust accounts examination is CRA’s way of checking that you’re handling payroll deductions, GST/HST, and other collected amounts properly. You’re holding those funds in trust for the government. This means it isn't your money, it's the CRA's. That’s why they take it seriously.

If you collect HST from your customers or deduct payroll taxes from your employees’ paycheques, you’re expected to remit that on time. CRA can and does check whether you’re doing it right.

They even explain it clearly on their site:

→ CRA Trust Accounts Examinations Overview

Here’s the part CRA doesn’t hide and it’s something most small businesses don’t realize.

You’re more likely to be selected for an examination if you hit one or more of these red flags:

If you’re three years behind on HSTfilings or chronically late with remittances, your file’s probably already on their radar.

People like to think CRA just "randomly" targets taxpayers. But honestly, they’re surprisingly open about how trust exams are triggered and how they’re conducted. They post publicly, and have a YouTube video:

If you’ve never seen these before, it’s worth reading. It’s basically a public guide to how they choose who gets examined and what happens after.

Usually, CRA contacts you by letter or phone, asking for records. Here’s what they might request:

It’s like an audit, but specifically for the “trust” taxes like payroll and GST/HST. And yes, it can lead to penalties and interest.

A lot of small business owners think trust exams “just happen” out of nowhere. But when I look at the file, it’s usually the same pattern:

"Forgot to file GST for a couple of years."

"Wasn’t sure if I had to send payroll taxes for my employees."

"Just waiting until I catch up with my books."

Here’s an actual question I saw on JustAnswer:

“Forgot to file GST for 2021 and 2022. Nothing has happened yet. Am I in trouble?”

The answer? Possibly. You might not hear anything right away, but CRA runs risk scoring models that flag files with missing or late compliance. Eventually, you’ll get a letter. Or worse, a reassessment and penalties.

More discussion here from Reddit users who’ve gone through it:

→ Reddit – CRA Payroll Audit Question

If you think you’re at risk or you’ve already gotten the letter do not wait. You need to speak with a CPA in Ottawa right away.

Also, if you’ve had poor compliance over multiple years, consider a Voluntary Disclosure. CRA has a whole program for this but once they contact you, it's too late.

Trust exams aren’t random. If you’re behind on filings or remittances, it’s a question of when, not if. CRA has made it very public how and why they do this. And if you’re already on their radar, you’re not alone.

I’ve helped businesses across Canada (especially in Ottawa) get back on track after years of missed GST or payroll filings. It’s not fun, but it’s fixable if you deal with it head-on.

If you're already in this situation or you want to avoid it altogether, feel free to reach out. You don’t need to navigate CRA on your own.

More Reading:

Want to talk it through? You know where to find me.

--

This is not legally binding tax advice. This is educational analysis. Say hello if you need help.

WhatsApp - 613.600.4194

--

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without a specific consultation. Lucas CPA Professional Corporation will not be held liable for any problems that arise from the usage of the information provided on this page.