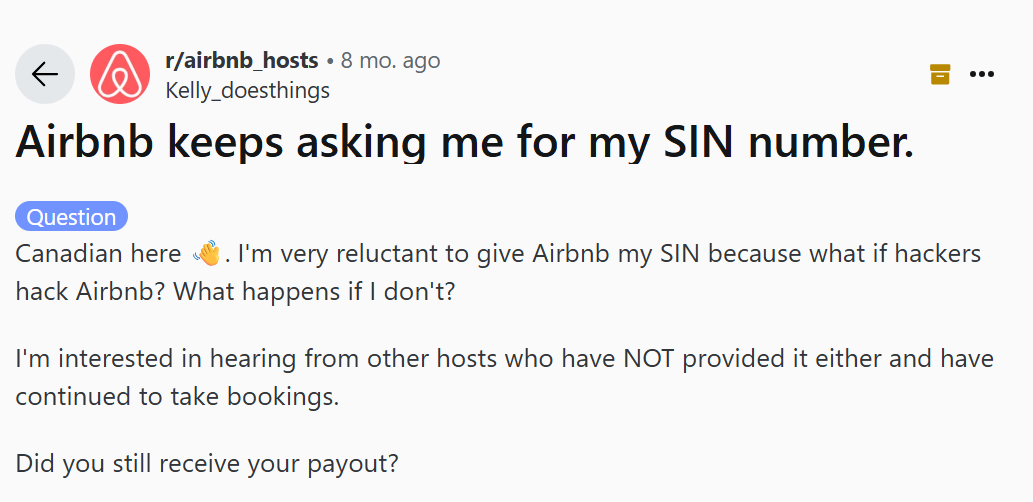

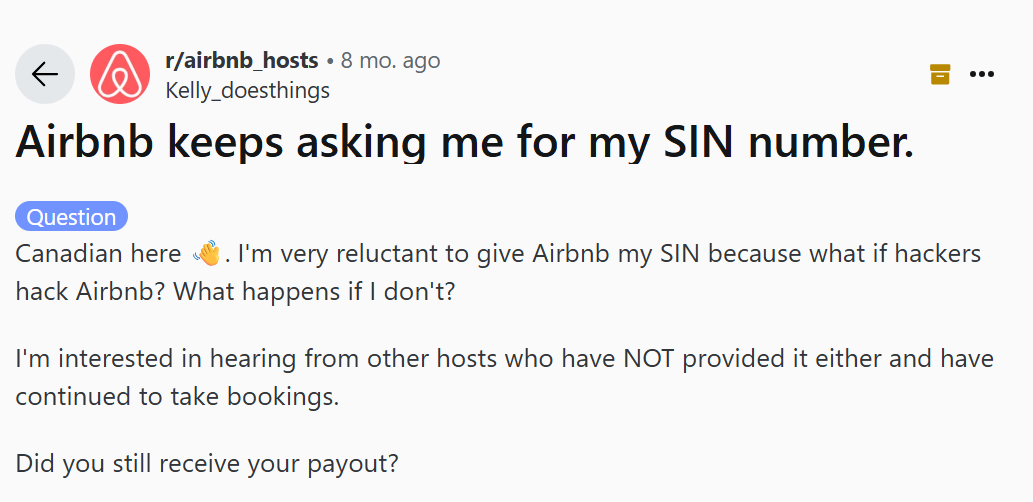

I get asked this all the time, especially around tax season:

“Airbnb is asking for my SIN. Am I supposed to be paying tax on this income?”

It's also been posted about on this Reddit Page, which is important meaning people are talking about it.

Yes, Airbnb income is taxable in Canada, and CRA is paying closer attention than ever. And yes, Airbnb is legally allowed to ask for your SIN now. Airbnb will suspend your payouts if you do not provide tax ID. Here’s what’s going on and what you should know.

If you're renting out a home, basement, cottage, or even a single room on Airbnb, you’re earning rental income, and the CRA expects you to report it.

This applies whether:

Even if you never receive a T4A or tax slip from Airbnb, you still need to report that income on your tax return under rental or business income.

Starting recently in 2025, Airbnb is collecting SIN numbers from Canadian hosts. Why?

Airbnb, like other digital platforms, is now required to report income details to CRA under the new platform-based economy tax rules.

According to Airbnb’s own policies and confirmed by Lodgify:

“Airbnb is now collecting tax identification numbers in Canada as part of legal requirements to report host income to the CRA. If you don’t provide your SIN, Airbnb may withhold payouts.”

That means the CRA will know how much you made, even if you don’t tell them yourself.

If you underreport or don’t report your Airbnb income, CRA could:

In some cases, I’ve seen hosts hit with years of back taxes, especially if their Airbnb was running as a full-time business or generating thousands in annual income.

Maybe. If your Airbnb earnings go over $30,000 in a 12-month period, you’re required to register for a GST/HST number and collect/remit tax on your bookings.

But thanks to recent CRA rules, Airbnb now collects GST/HST on your behalf for most short-term rentals in Canada.

Still, it’s your responsibility to:

Yes, you can claim related expenses, but keep records. The CRA has even changed the rules for 2024. According to this CRA bulletin, the way you claim repairs, capital expenses, and interest is now more restricted.

Common deductions include:

You can’t claim personal use portions. If you only rent the property part of the year or only a few rooms, you’ll need to prorate your expenses.

CRA is offering more online compliance programs and matching Airbnb payouts with tax returns. If you forgot to report income in a previous year, now is a good time to:

A proactive fix often avoids penalties and reduces interest, and keeps CRA from escalating things further.

If you’re earning Airbnb income in Ottawa, Gatineau, or anywhere in Canada, yes, it’s taxable, and yes, the CRA wants their share.

Airbnb asking for your SIN isn’t random. It’s part of a broader push to bring short-term rentals under tighter tax compliance rules.

If you’re confused about how to report it, claim deductions, or whether you should register for HST, don’t guess. I help Ottawa hosts file correctly and avoid CRA penalties.

Related Links and References:

--

This is not legally binding tax advice. This is educational analysis. Say hello if you need help.

WhatsApp - 613.600.4194

--

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without a specific consultation. Lucas CPA Professional Corporation will not be held liable for any problems that arise from the usage of the information provided on this page.